Texas is known for its strong economy, no state income tax, and growing population but when it comes to property taxes, many residents and investors are surprised by how high they can be. Understanding the Texas property tax comparison with other states can help you better manage your costs and make informed decisions about homeownership and investment.

Why Are Texas Property Taxes So High?

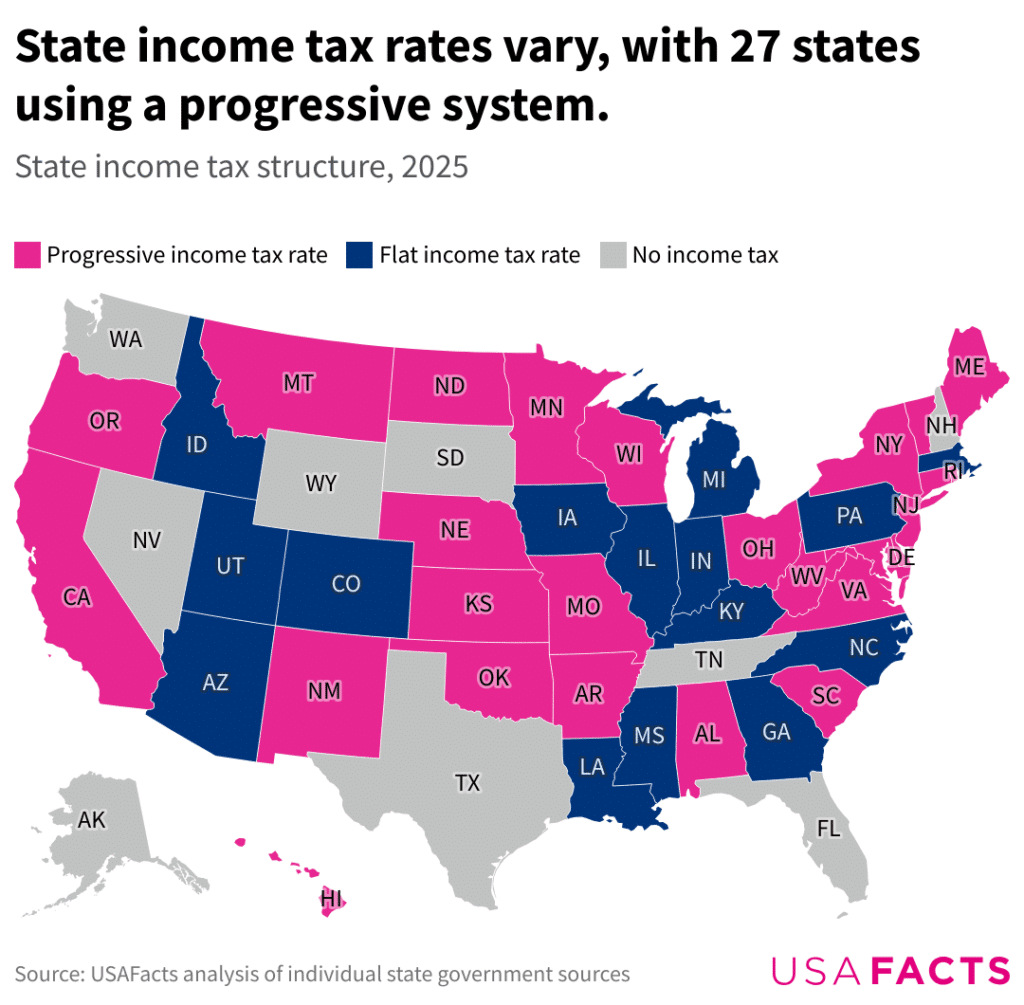

One of the main reasons Texas has higher property tax rates is because it does not collect state income tax. That means local governments rely heavily on property taxes to fund schools, roads, emergency services, and other public needs. The burden falls squarely on property owners, highlighting the importance of a Texas property tax comparison for potential homebuyers.

- No state income tax – Revenue has to come from somewhere.

- Local funding model – Public services, especially school districts, depend on local property taxes.

- Rapid growth – As property values climb, so do tax bills, unless successfully protested.

Texas vs. Other States: A Tax Rate Comparison

According to recent data from the Tax Foundation, Texas consistently ranks among the top states for highest average property tax rates. Here’s how Texas compares in property taxes: a crucial Texas property tax comparison is evident when matching with other states such as California, Florida, and New York.

- Texas: Average effective property tax rate is around 1.6%–2.0%, depending on the county.

- California: Roughly 0.7%, thanks to Proposition 13 which limits annual increases.

- Florida: Averages around 0.9%.

- New York: Varies greatly, but some counties exceed 2.5%.

- Colorado: One of the lowest, typically under 0.6%.

While some states may have higher nominal tax rates, their lower property values or exemptions keep the actual bills manageable. In Texas, even modest homes can come with surprisingly large tax bills, further stressing the need for a thorough Texas property tax comparison.

What About Exemptions and Caps?

Texas does offer several exemptions that can help lower property tax bills:

- Homestead exemption: Lowers taxable value for primary residences.

- Over-65 exemption: Additional savings for seniors.

- Disability and veteran exemptions: For qualifying individuals.

There’s also a 10% appraisal cap on homesteads, which limits how much the appraised value can increase each year but this doesn’t apply to rental or investment properties.

Out-of-State Property Owners Take Note

Many out-of-state investors are shocked by the difference in tax burdens when purchasing in Texas. In states like California or Florida, property taxes may remain predictable or lower due to laws that cap assessments. In Texas, however, yearly increases can be significant unless actively managed through the protest process.

The Role of Protesting in Managing Taxes

The good news is, Texas law allows property owners to protest their valuations each year. This gives you a chance to correct overvaluations, compare with similar properties, and potentially save thousands.

At TexasPVP, we specialize in:

- Reviewing your valuation for errors

- Gathering market data to support your case

- Representing you at hearings

- Helping both homeowners and investors keep taxes in check

What This Means for You

Whether you live in Texas or invest from out-of-state, understanding how the property tax system works and how it differs from other states is essential to protecting your bottom line. High rates make it more important than ever to review and protest your property’s value each year.

Work With Experts Who Know the Texas System

TexasPVP helps property owners navigate one of the most aggressive property tax systems in the country. We use local expertise, data-driven strategies, and personalized service to make sure you’re not overpaying.

Ready to take control of your Texas property taxes? Contact TexasPVP today to get started.