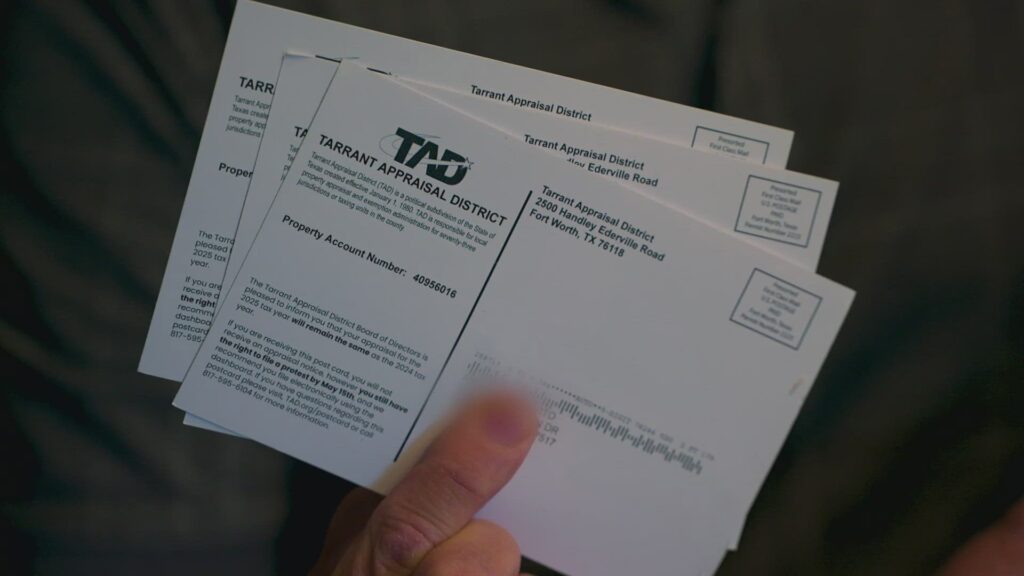

Good News for Tarrant and Collin County Property Owners: Extended Deadline to Protest Property Taxes Until June 1, 2025

If you live in Tarrant or Collin County, you have until June 1, 2025, to protest your 2025 property tax assessment. This gives you a vital opportunity to correct overassessments, secure exemptions, and reduce your tax bill—potentially by thousands. Based on guidance from the Texas Comptroller’s Office, this updated guide from TexasPVP outlines what actions to take and how to prepare before the extended deadline passes.

Why File a Property Tax Protest?

Overassessed property values mean higher taxes. Since property taxes are based on your property’s assessed value multiplied by the local rate (e.g., 2.1%), even a small error can add up. For example, a $50,000 overvaluation can cost you $1,050 per year. Filing a protest by June 1 can:

- Lower Your Taxes: Fix overvaluations or errors.

- Ensure Accuracy: Use evidence to reflect your property’s true market value.

- Increase Long-Term Savings: A $40,000 reduction equals $840/year or $8,400 over 10 years.

What You Can Do Before June 1, 2025

1. File a Protest

TexasPVP helps you file your protest quickly and accurately, challenging unfair assessments based on market value, errors, or exemptions.

- How to File: Visit TexasPVP.com or call (682) 263-0305. You can submit your protest online or get assistance with mailing or in-person options.

- What You’ll Need: 3–5 sales comps, repair estimates, or photos. TexasPVP can help you prepare a solid evidence package.

- Example: Lowering a $460,000 assessment to $430,000 can save $630 annually.

2. Correct Errors on Your Notice

If your property has incorrect data—like square footage, lot size, or building condition—TexasPVP can help you file a Motion to Correct using blueprints, surveys, or other documentation.

- Example: Fixing a 200 sq. ft. error could save $630 annually.

3. Apply for Property Tax Exemptions

TexasPVP assists homeowners in applying for all eligible exemptions:

- Homestead: Up to $100,000 off assessed value.

- Senior Citizen (65+): Freezes school taxes and adds extra reductions.

- Disabled Veterans: Partial to full exemptions based on disability rating.

- How to Apply: TexasPVP can file on your behalf or help you complete the necessary forms and gather documents.

4. Prepare for ARB Hearings

If your protest proceeds to an Appraisal Review Board (ARB) hearing, TexasPVP will help you:

- Collect comps, repair estimates, or income data (for commercial).

- Organize a binder or digital packet.

- Rehearse your presentation to make the strongest case possible.

5. Plan Now for 2026

Whether you missed the deadline or want bigger savings next year:

- Start saving comps and repair evidence now.

- Review your 2025 notice for recurring errors.

- Learn the process with TexasPVP’s expert guidance.

Real Client Example

Sarah, a Tarrant County homeowner, suspected her 2025 property was overvalued at $470,000. With help from TexasPVP:

- She filed before June 1, using three comps and a $10,000 HVAC repair estimate.

- Her ARB hearing resulted in a $40,000 reduction, saving $840.

- She also applied a $50,000 homestead exemption, saving another $1,050.

- Total 2025 savings: $1,890

Why Act Now?

Filing with TexasPVP before June 1, 2025:

- Saves You Money: A $50,000 reduction = $1,050/year at 2.1%.

- Corrects Errors Quickly: Year-round support for fixing data mistakes.

- Sets You Up for Success: TexasPVP builds your case and manages the process.

Get Started Today

Visit TexasPVP.com or call (682) 263-0305 to get expert help filing your 2025 protest.