Tax caps are one of the most misunderstood parts of the Texas property tax system. While they are designed to protect homeowners from dramatic increases in their property tax bills, the reality is more nuanced. Whether you’re a homeowner or an investor, understanding what tax caps actually do and don’t do can help you make smarter financial decisions and build a stronger protest case.

At TexasPVP, we educate property owners on how tax caps work and where they can lead to false assumptions or missed opportunities. Here’s what you need to know.

What Is a Tax Cap in Texas?

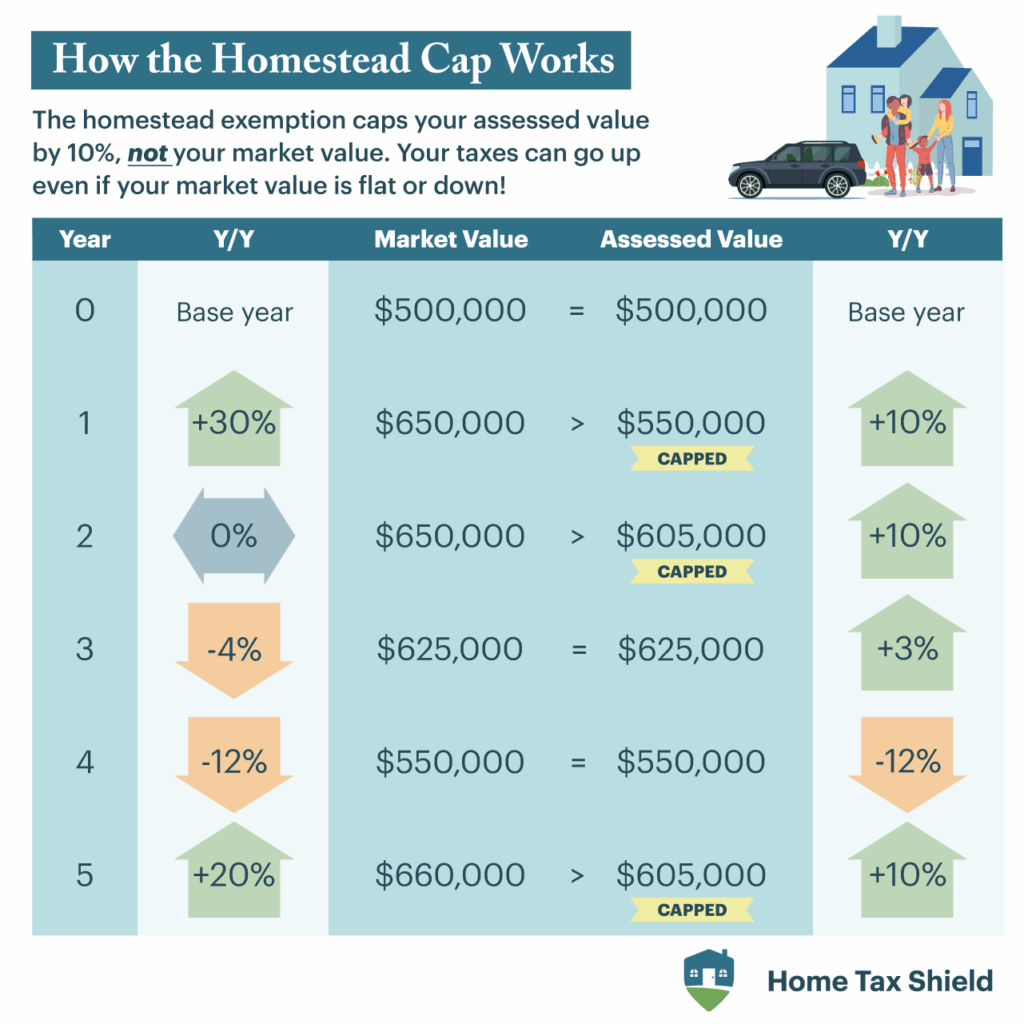

Texas places a limit or “cap” on how much the assessed value of a homestead property can increase each year for tax purposes. This cap is generally 10%. That means, even if your market value skyrockets, the taxable value can’t go up more than 10% annually, provided the property qualifies as a homestead.

However, there are important limitations:

- It applies only to homestead properties not rental homes, commercial properties, or investment real estate.

- It does not limit the market value increase just how much of that increase gets taxed.

- It resets when ownership changes if you buy a new home, the cap no longer applies until the next year.

Common Misconceptions About Tax Caps

Myth 1: The cap limits my taxes.

Truth: The cap limits your assessed value increase, not your total tax bill. Your actual taxes can still rise due to changes in local tax rates, bond approvals, or special assessments.

Myth 2: All properties have a cap.

Truth: Only primary residences with a homestead exemption are protected. Commercial properties and second homes are not capped.

Myth 3: If I protest my value, I could lose my cap.

Truth: Protesting your value will not remove the cap if your homestead exemption is in place. In fact, it could help reduce your value and keep it low for future years.

How Tax Caps Impact Your Property Tax Protest

Tax caps can give property owners a false sense of security. If you rely on the cap to control your taxes without protesting an inflated market value, you may end up with:

- A higher baseline for future increases

- Reduced eligibility for other protests like equity or unequal appraisal

- Less negotiating power with the appraisal district

For commercial or investment properties, the absence of a tax cap means year-to-year increases can be steep — and a strong protest becomes even more critical.

When Tax Caps Can Hurt You

Here’s where things get tricky. Suppose your market value is significantly over-assessed but your taxable value is capped. If you don’t protest the market value, that inflated number stays in the system. Over time, the capped value “catches up,” and you’re taxed on an unfairly high amount. The cap delayed the pain but didn’t prevent it.

That’s why TexasPVP always looks at both the market value and the capped assessed value. We build protests that protect your future not just your current bill.

How TexasPVP Helps You Navigate Tax Caps

- We assess whether your market value is overinflated even if your current tax bill is capped

- We file timely and well-documented protests to lower your market value

- We help you understand how caps work, when they apply, and when to take action

- We represent all types of property owners, including commercial, residential, and out-of-state investors

Bottom Line: Don’t Let a Cap Fool You

Tax caps can be helpful, but they’re no substitute for a well-executed protest. Whether you’re new to the system or have been relying on your homestead exemption to keep taxes down, it’s time to take a closer look. At TexasPVP, we help you stay ahead of hidden tax risks and fight back when your valuation is unfair.

Need help reviewing your property tax situation? Contact TexasPVP today for expert support and local insight.