Filing a Texas property tax protest is a smart first step toward reducing your tax bill but what happens next? Understanding the property tax appeal process is crucial. At TexasPVP, we believe every property owner should understand the full journey. Whether you’re protesting as a homeowner, investor, or commercial property owner, managing your expectations after you file is key to staying informed and confident throughout the process.

In this post, we’ll walk you through what to expect after your protest is submitted, explain the difference between informal and formal hearings, clarify how your evidence is reviewed, and show how TexasPVP stands by you from start to finish.

The First Step: Acknowledgment of Your Protest

After you file your property tax protest either online or by mail your local county appraisal district will send you a confirmation. This usually includes:

- A protest case number

- Notice that your protest has been received

- Instructions on the next steps, such as scheduling

Once this acknowledgment is issued, the real process begins.

Informal Review: Your First Opportunity to Settle

Many protests are resolved during the informal hearing, which is a private meeting between you (or your representative) and an appraiser from the county appraisal district. This meeting may take place in person, by phone, or virtually.

What Happens During the Informal Review:

- The appraiser presents their evidence supporting your current valuation.

- You (or TexasPVP) present counter-evidence such as comparable sales, market analysis, photos, or condition reports.

- If both sides agree on a reduced value, your protest is resolved without needing to go to a formal hearing.

Note: This stage is where many tax protests are successfully resolved especially when you’re well-prepared or represented by professionals like TexasPVP.

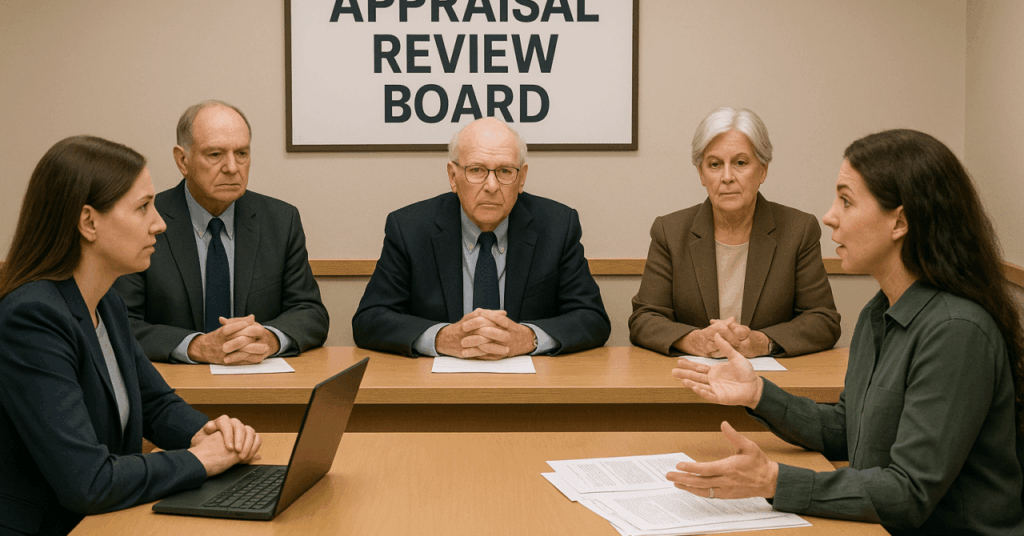

Formal Hearing: The Appraisal Review Board (ARB)

If no agreement is reached during the informal meeting, the next step is a formal hearing before the Appraisal Review Board (ARB). This is more structured and functions like a mini court session.

What to Expect:

- A panel of three trained ARB members will hear your case.

- You and the appraisal district representative will each present evidence.

- You’ll have the chance to respond to questions and explain your position.

- After both sides are heard, the ARB makes a decision.

This hearing is usually held at the county appraisal district’s office or a designated location.

What Documents Are Reviewed?

Whether your case is resolved informally or through a formal hearing, strong documentation is essential. The following types of evidence are commonly reviewed:

- Sales Comparables: Recently sold properties similar to yours, adjusted for differences.

- Property Condition Photos: Evidence of damage or deferred maintenance.

- Independent Appraisals: Private reports that support a lower value.

- Market Reports: Trends showing declining property values or rental income.

- Income Approach (for commercial/investment properties): Financials showing lower operating income or occupancy.

At TexasPVP, we gather and organize all these materials for you so your case is clear, professional, and well-supported.

What Happens If You Win?

If the ARB agrees with your argument and lowers your assessed value:

- Your taxable value is reduced, which can lower your tax bill significantly.

- Future tax years may also benefit if local caps slow down how fast your value can increase again.

- If you’ve already paid based on the original value, you may receive a refund or tax credit.

Many TexasPVP clients see savings that exceed the cost of our services often by thousands of dollars per year.

What Happens If You Lose?

If the ARB sides with the appraisal district:

- You’ll pay property taxes based on the originally assessed value.

- However, you still have options:

- Request Binding Arbitration

- Pursue a Judicial Appeal

- Refile the following year with stronger evidence

TexasPVP can guide you on the best path forward and prepare you for a stronger case next time, if needed.

How Long Does the Process Take?

From protest submission to resolution, the process usually spans 4 to 12 weeks, depending on:

- County backlog

- Hearing scheduling timelines

- Whether the case is resolved informally or goes to a formal hearing

TexasPVP keeps you informed every step of the way, so you always know your protest status.

How TexasPVP Supports You from Start to Finish

Protesting property taxes isn’t just about filing paperwork it’s about building and presenting a compelling case. At TexasPVP, we make the process simple and effective:

- We handle all communication with the appraisal district.

- We prepare your evidence using market data, sales comps, and property analysis.

- We attend all meetings and hearings on your behalf.

- We provide updates so you’re never left wondering where your case stands.

Whether you’re a first-time protester or a seasoned property investor, TexasPVP brings expert insight, strategic preparation, and proven results to your protest.

Final Thoughts

Filing your property tax protest is just the beginning and knowing what happens after you file can make all the difference. With the right evidence, support, and guidance, you can turn a stressful process into a smart financial decision.

Let TexasPVP handle the process for you so you can focus on what matters your investment, your home, and your bottom line.

Have a protest coming up? Contact TexasPVP today and get the professional support you need to win.