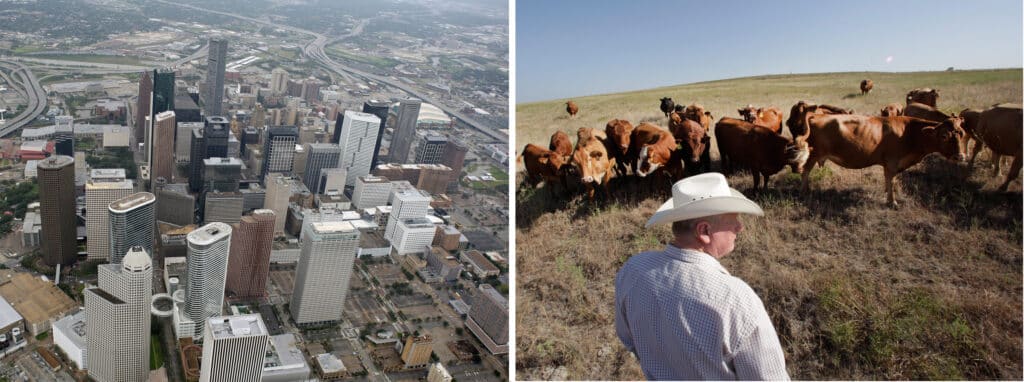

When it comes to property taxes in Texas, understanding rural urban property taxation is crucial because where your property is located can significantly impact how it’s appraised and how much you pay. Many property owners are surprised to learn that rural and urban properties are often treated quite differently by local appraisal districts. At TexasPVP, we help owners understand these distinctions. We use them to build stronger property tax protests.

In this guide, we break down the core reasons appraisal districts assess rural and urban properties differently. We explain what that means for your property tax bill.

Understanding the Appraisal District’s Role

Each county in Texas has its own appraisal district responsible for valuing properties annually for tax purposes. These districts follow statewide rules set by the Texas Comptroller. They also consider local market data, land use, and economic conditions.

Rural and urban areas have vastly different characteristics such as infrastructure. Their development patterns and land use differ too. Therefore, appraisal districts apply different valuation methods and benchmarks.

Key Differences Between Rural and Urban Appraisals

1. Market Data Availability

- Urban Properties: Urban areas typically have more real estate transactions. This gives appraisal districts access to richer market data for comparative analysis. It often results in more precise appraisals. However, it also leads to quicker valuation increases when markets heat up.

- Rural Properties: In rural areas, there are fewer sales and less consistent data. This makes it harder to determine fair market value. Appraisers may rely more on estimations or regional averages. This approach can sometimes lead to inaccurate assessments.

2. Land Use Considerations

- Urban Properties: In cities and suburbs, land is often zoned for residential, commercial, or industrial use. The value is heavily tied to the development potential and infrastructure access (like roads, utilities, and schools).

- Rural Properties: Land may be used for agriculture, grazing, timber, or left undeveloped. These uses can qualify for special valuation methods—such as agricultural exemptions that significantly reduce taxable value.

3. Improvements vs. Raw Land

- Urban Properties: The appraisal focus is often on structures, such as homes, buildings, and renovations. This is because land is typically a smaller part of the total value.

- Rural Properties: The land itself often makes up the majority of the value, especially if it spans large acreage. Improvements like barns or older houses may have minimal impact on the overall assessed value.

4. Access to Services

- Urban Areas: Being closer to city services such as water, sewer, emergency services, and public transportation raises property values. Appraisal districts factor in these benefits when assessing urban properties.

- Rural Areas: Lack of infrastructure can limit property value. However, this doesn’t always stop appraisers from assigning higher values based on perceived growth or development potential.

Special Considerations for Rural Property Owners

If you own rural land in Texas, you may be eligible for special tax treatments that urban properties don’t qualify for. Such treatments include:

- Agricultural Exemption (1-d-1 appraisal): Land used primarily for agriculture can be taxed based on its productive value rather than market value.

- Timber or Wildlife Management Exemptions: These programs offer additional options for reducing taxes on rural acreage.

- Open-Space Use Valuation: Common in rural counties, this allows for lower taxation based on how the land is actually used. It does not depend on how much it could sell for.

If these exemptions are not properly applied, rural owners can end up with inflated assessments. These assessments might not reflect their land’s actual use.

Urban Owners Face Their Own Challenges

Urban property owners might not have access to the same exemptions, but they face other valuation issues such as:

- Rapid development driving up values

- Overvaluation based on nearby commercial growth

- Unequal appraisal compared to similar properties

If your urban home or building is assessed much higher than similar ones nearby, you may have grounds for a protest. This also applies if market trends have been misapplied.

How TexasPVP Helps Both Rural and Urban Owners

At TexasPVP, we understand the specific rules and common mistakes that affect both rural and urban properties. Whether your property is a ranch outside Abilene or a duplex in Austin, we tailor our approach to the context of your location and land use.

Our team can help:

- Evaluate whether your rural land qualifies for an exemption

- Analyze market data and comparable sales for urban properties

- File and represent your protest through both informal and formal hearings

- Identify if your property was assessed unfairly compared to similar parcels

The Bottom Line

Your property’s location, whether rural or urban, is more than just a spot on a map. It plays a major role in how appraisal districts determine value. It also affects what exemptions you may be eligible for and how much you ultimately pay in property taxes.

Understanding these differences is key to building a strong, successful protest. TexasPVP is here to help you every step of the way.

Need help understanding your property tax valuation? Contact TexasPVP today and let our local expertise work for you no matter where your property is in Texas.